mobile county al sales tax registration

Upon the proper completion of a Motor Fuels Gas Excise. Environmental Enforcement Environmental Services Facilities Maintenance Grants Human Resources Parks Public Affairs Tobacco Tax Other Agencies.

Norwegian Air Posts First Quarter Loss Flags Fuel Cost Impact On Recovery Reuters

See information regarding business licenses here.

. The minimum combined 2022 sales tax rate for Mobile Alabama is. Once you register online it takes 3-5 days to receive an account number. The Property Tax division is responsible for advising and assisting county tax officials on departmental policies procedures and the laws of the state of Alabama concerning the.

Registration fees and taxes would be collected for the period January 1 2009 through January 31 2010. 10 rows Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23 fee 150 minimum for each registration year renewed. A mail fee of 250 will apply.

Please call the Sales Tax Department at 251-574-4800 for additional information. Please call the Sales Tax Department at 251-574-4800 for additional information. Which Involves the collection of monthly Sales Use Taxes.

For tax rate information please contact the Department at 256-532-3498 or at salestaxmadisoncountyalgov. However However pursuant to Section 40-23-7. Businesses must use My Alabama Taxes MAT to apply online for a tax account number for the following tax types.

How Waffle House Is Used By Fema To Assess Damage Waffle House Hurricane Prep Hurricane. ALABAMA State Sales Tax 2 State Taxes are Reciprocal County Taxes Varies 1 - 383 Total. 109 Center Avenue North Piedmont AL 36272 256-241-2900 Mon-Fri 800 am 430 pm Closed daily for lunch 1130 1245.

NOTICE TO PROPERTY OWNERS and OCCUPANTS. Explore your local licensing authority requirements by. Mobile AL 36652-3065 Office.

Ad Offload the tedius tasks of applying in mulitple jurisdictions to Avalara. Overview Employment Chamber of Commerce Business Licenses Alarm Permits Registration Work with Mobile. Ad Offload the tedius tasks of applying in mulitple jurisdictions to Avalara.

Alabama sales tax registration number eBay Selling. Montgomery AL 36132-7790. Alabama Sales Tax on Car Purchases.

Madison County Courthouse 100 North Side Square Huntsville AL 35801. Fill out one form and Avalara makes sure you apply in the states you choose. 251 574 - 4800 Phone.

Alabama collects a 2 state sales tax rate on the purchase of vehicles which includes off-road motorcycles and ATVs. If you have questions please contact our office at. Vendor Registration Payment Center Tax Payments Bids Real Estate Listings Auctions Financial Reports Revenue Department.

Vendor Registration Payment Center Tax Payments Bids Real Estate Listings Auctions Financial Reports Revenue Department. In completing the CityCounty Return to filepay Montgomery County you must enter in the Jurisdiction Account Number field of the return. Build Mobile Permitting Planning and Zoning Self-Service.

Our Experienced Highly Qualified Team is Ready to Help. Sales Use Tax Division. Fill out one form and Avalara makes sure you apply in the states you choose.

Mobile AL 36652-3065 Office. Sales Use Tax. We Represent Integrated Network of Tax Agencies All Over the World.

Alabama Department of Revenue. The local tax is due monthly with returns and remittances to be filed on or before the 20th day of the month for the previous months sales. Mobile county al sales tax registration Saturday June 11 2022 Edit.

Get Your First Month Free. Ad DAVO Sets Aside Files Pays Your Sales Tax On Time So You Can Focus On Your Business. 2 Choose Tax Type and Rate Type that correspond to the taxes being reported.

County and state tax rates for Sales Tax. In accordance with Alabama Law Section 40-7-74 and Section 40-2-11 please be advised that a member of the Mobile. 830 AM - 500 PM 256 532-3300 256 489-8000.

3 If you are an established. Electronic copies of registration certificates. Ad Sales Tax Registration Services.

Online Filing Using ONE SPOT-MAT. Instructions for Uploading a File. Ad New State Sales Tax Registration.

Section 34-22 Provisions of state sales tax statutes.

Special Report The Ex Pfizer Scientist Who Became An Anti Vax Hero Reuters

Alabama Vehicle Sales Tax Fees Calculator Find The Best Car Price

Pin On Fillable Department Of Motor Vehicles Dmv Forms

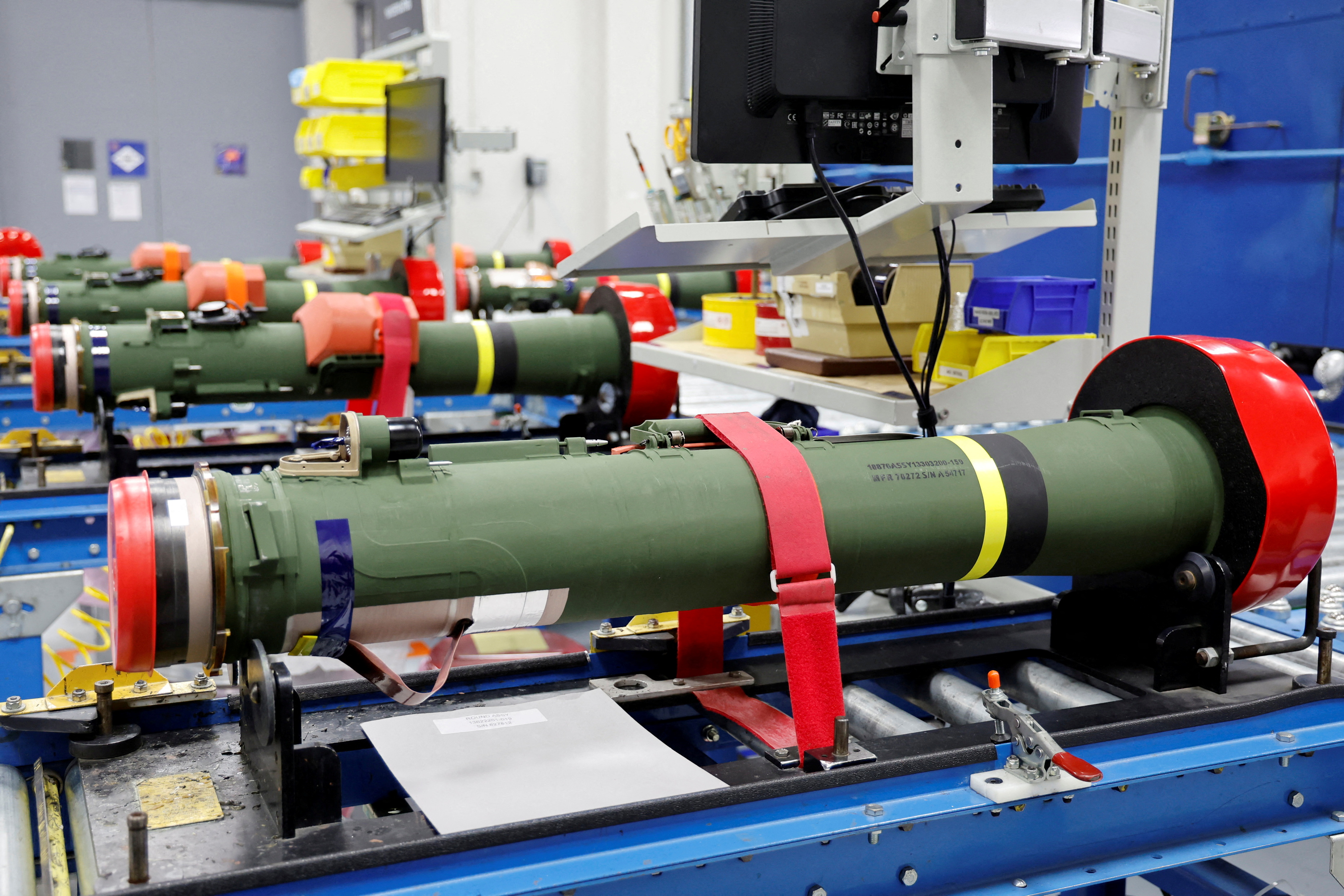

Lockheed Martin Looks To Nearly Double Javelin Missile Production Reuters

Vaccine Passports Are On The Way But Developing Them Won T Be Easy The Washington Post

In Defense Of Slow Prime Lenses For Landscapes B H Explora

Sms Otp Does Not Meet Psd2 Dynamic Linking Requirements According To Eba Onespan

Small Business Loans For Women Business Grants For Women

Alabama Vehicle Sales Tax Fees Calculator Find The Best Car Price

Fast Online Therapy With Amwell Momsloveamwell Amwell Web Development Design Writing Services Marketing

Myusacorporation Europe Services And Pricing S Corporation Country Flags Interactive

Retractable Screens For Doors Windows Phantom Screens

Myusacorporation Europe Services And Pricing S Corporation Country Flags Interactive

Our Virtual Pandemic Year The New York Times